So, you’re excited about college, but not so much about the cost? Feel like you could get into some pretty awesome schools, but think you might need a full ride (or almost)? Lots of APs/IBs, mostly As & Bs?

Great. This guide is for you.

The landscape of financial aid and scholarships is competitive, sure, but it’s also complex, with lots of labyrinths you can’t predict on your own. This guide will show you how to play the game.

Before we dive in, let’s make sure you’re in the right place. This guide applies only to:

US Citizens. For non-citizens and international students, see “Developing a College List on a Budget: A Guide for International Students or Resources for Undocumented Students Applying to College.”

Students whose families make under $80-120K per year, depending on where you live.

Students with mostly As & Bs in an AP/IB-heavy curriculum (unless your school doesn’t offer many or any APs/IBs).

For students who are US Citizens, but don’t meet criteria #2 and #3 above, “Paying for College in 4 Easy Steps” may be a more helpful resource for you.

If the above criteria do apply to you, and you have an appetite for information, “Paying for College…” is still an amazing resource for you. It just covers a lot more than list-building. This guide, on the other hand, aims to provide more concise direction toward building your college list.

TABLE OF CONTENTS

(click to skip ahead)- Are there colleges that are free?

- So, do I just apply to some schools that meet 100% of need, and hope for the best?

- How do these figures inform what schools I should apply to?

- What if I don’t get into any colleges?

- So, what does it really look like for a school to “meet my need?”

- How can I avoid taking on too much debt for college?

- Great. Now what do I do with all of this information?

Are there colleges that are free?

In some ways, yes. What if I told you there are schools out there that will give you all the money you need? That, if you’re admitted, the money will take care of itself? There is a small group of about 80 schools that “meet 100% of demonstrated need” for all admitted students. This database lists these schools, along with some other data points that will be discussed later in this guide.

When reviewing your financial aid application, including your family’s tax returns, these schools calculate how much your family can afford, then cover the remaining cost with their own scholarship money. Think of it like a sliding scale, a pay-what-you-can discount.

Important disclaimer—the colleges decide what you can pay. You might be skeptical: do they really offer a fair discount at the end of the day? In my experience, in the vast majority of cases, for students from low-income backgrounds, yes. These schools’ financial aid packages are typically the best out there.

So, do I just apply to some schools that meet 100% of need, and hope for the best?

No. We can actually predict what each college’s calculator is going to determine your family can afford. While this may sound like a behind-closed-doors determination, these calculators are actually public.

The CollegeBoard (you remember them, right?) provides a calculator with which you can predict your “Student Aid Index (SAI)” (formerly termed Expected Family Contribution or EFC). Do this first. Do not skip this step.

- When prompted, select "Both FM & IM." You'll get two figures—this will be your "EFC range."

- You will likely not know the answers to every question. Ask your parents, guardians, and/or older siblings for help.

- Most colleges’ “net price calculators” (specific to their own policies) are linked to this calculator. So now you can predict the cost at virtually any school!

Once you’ve completed the CollegeBoard’s calculator, discuss the range with your parents. Their comfort level around cost is their “perceived need,” and we want to determine how much this aligns with “demonstrated need.”

If the amount your parents would need to pay per year out of pocket (not including loans—more on that later) would be somewhere in this range, how would they feel? Thrilled? Reluctant but willing? Or highly hesitant or totally unwilling?

How do these figures inform what schools I should apply to?

Regardless of your parents’ reactions, there are pathways for you. If the calculator’s range was below $20K, follow the steps in this flowchart.

If the figures were more in the range of $20-35K, use this one instead. And a heads up that Paying for College in 4 Easy Steps may be a more helpful resource for you.

You’ll notice some of the boxes in the flowcharts advise you to consider applying Early Decision. A few key points about ED:

It’s a binding application. It’s almost like making a deal with the school, saying, “I am so interested in this college that, if you admit me, I will pre-commit to attending.”

Such a deal entices the college to admit more liberally from the Early Decision rounds than Regular Decision. As the database shows, admit rates in ED are almost always higher.

In most cases, you can exit an Early Decision agreement if the financial aid package does not reflect the school’s net price calculator (available on every college’s website).

What if I don’t get into any colleges?

This question comes up for most students at various stages of the college application process. Sometimes it’s just plain old anxiety talking, but it’s a fair question, and an important one to consider before you apply, so you can build a smart college list. How can you make sure you’re set up with a safe list? A heads up that CEG is super wary of chancing calculators, but the second tab of the database breaks up likelihood by round. A few points to consider as you aim to build a “balanced” list.

To keep you safe, it’s important to include 2-3 “likely” schools and 2-3 “possible” schools on your list.

Equally important is that 2-3 of these “likelies” and “possibles” are likely to give you the financial aid you need. A school may have a 90% admit rate, but if their financial aid policies don’t guarantee to meet your need, it’s not a “safety” for you; it’s a gamble.

It’s okay to have lots of “reaches,” but consider ED1 and ED2 to maximize your chances of accessing one of them.

With “far reaches,” be sure you’re paying attention to reality. It may be tempting to say “well, you never know!” In fact, sometimes we can know. A student with a 3.5 unweighted GPA, for example, has virtually zero chance of admission to Harvard; it’s not worth wasting the time to apply, when that time could be better spent elsewhere.

So, what does it really look like for a school to “meet my need?”

This’ll be easier to understand if we talk concretely, so let’s take Colgate University as an example. If you’ve never heard of Colgate, you should know that their financial aid policies are pretty incredible (if you want to apply there, here’s a guide to Colgate’s supplemental essays).

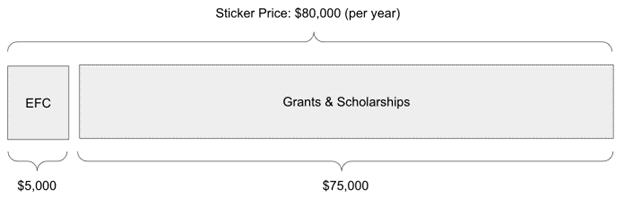

While the sticker price at Colgate is roughly $80,000 per year (for easy math, let’s use this round figure), the University commits to meeting full need for every admitted student. What’s more, Colgate is a “no-loan” school for families who make under $125,000 per year (More on this later).

Let’s say your family’s EFC is $5,000 per year. At Colgate, then, your need would be the difference between $80K and $5K. Yep, $75K! That’s what you could expect your financial aid package to total at Colgate. If you get in. And therein lies the challenge. But it’s a pretty sweet deal if you are admitted:

As a student with limited income, you’ll want to not play the game of applying for a million scholarships and hope you get them. Nor apply to a million schools and hope one of them randomly decides to give you the money you need. No. The game is to vie for admission to one of these selective, well-endowed schools that will meet your family’s entire demonstrated need.

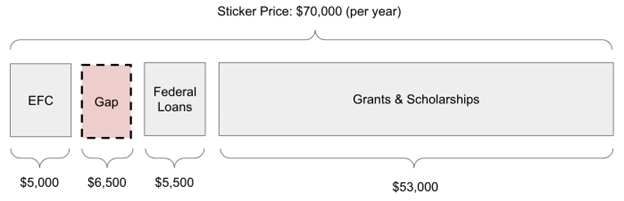

Let’s use the same math as above, but let’s change one factor—% of need met. Let’s say that, on average, Hogwarts University meets 90% of need. This is an average, not a guarantee. But let’s say they do ultimately meet 90% of your need. And let’s say this school is a bit less expensive at a meager $70,000 per year (college costs are crazy these days). Doesn’t sound too bad, right? Let’s visualize the math:

If your family’s EFC is $5,000, and the total cost is $70,000, your need is $65,000. 90% of that need is $58,500, $5,500 of which comprises federal loans. We’re left with an extra $6,500 this is called a gap.

Where is this money supposed to come from? While the near-$60,000 award you’ve received seems amazing (and it kind of is!), is it enough? Your family can only afford $5,000, you’ll already have to take out $5,500 in loans, again, where does this extra $6,500 come from?

How can I avoid taking on too much debt for college?

Have you heard about the student debt crisis? That college costs are progressively rising, and so is student debt? That some students are in $80, $90, $100K of debt just from their undergrad?

The answer isn’t simply “no loans.” For most students, attending college without taking on any debt is not possible. And federal loans have low interest rates, and some of them don’t even start building interest until after you graduate.

Let’s look at some of this math more closely. Let’s pretend that you take out the maximum amount of subsidized loans (“subsidized” = no interest builds while you’re in college). The federal maximum for subsidized loans is $19,000 across your four years. Paying off $19,000 of loans might sound daunting, but it tends to be quite manageable with a college degree. The table below shows how much you would need to pay back, over how many years, and how much money you would need to earn to afford repayment. Interest rates fluctuate year to year, but for the following calculations we’ll use a rate of 5%:

Repaying $19,000 of Student Loans

| Monthly Payment | Years To Pay Off | Annual Salary Needed |

|---|---|---|

| $241 | 8 | $36,081 |

| $306 | 6 | $45,899 |

| $438 | 4 | $65,633 |

In contrast, if you were to attend Hogwarts University, you would likely need to take almost the entire gap out in additional loans. Considering the higher interest rates of Parent PLUS loans and private loans (let’s say 7%), as well as the additional debt you would need to take on at Hogwarts:

Repaying $48,000 of Student Loans

| Monthly Payment | Years To Pay Off | Annual Salary Needed |

|---|---|---|

| $654 | 8 | $98,163 |

| $818 | 6 | $122,753 |

| $1,149 | 4 | $172,413 |

Depending on the field you pursue, and where you live, a lot of starting salaries range from $40-60K per year (though STEM fields can definitely have higher starting and mean salaries). If you graduate from Hogwarts with the above levels of debt, you could find yourself in real trouble.

Really important side note: whether you know what you want to major in and what career you want to pursue or not, check out CollegeScorecard and look at the average salaries of graduates from some of the colleges you’re applying to.

Some debt is okay, but excess debt can quickly become dangerous.

Great. Now what do I do with all of this information?

Follow the steps in the flowcharts above.

You don’t have to apply to schools blindly. You don’t have to cross your fingers that you’ll receive enough aid to be able to afford a particular school.

There are tons of data out there to help you understand how much financial aid a given college offers. Maybe your dream school is a perfect financial fit. Or maybe it’s not financially feasible after all. Don’t forget that there are dozens of wonderful colleges out there that could be a great fit (academic, social, and financial) for you.

Special thanks to Logan for writing this blog post.

Logan Shearer studied English & Russian for four years in a rural Iowa town. Currently a college counselor with a college access program outside Chicago (alliteration unavoidable; I tried), he loves guiding students through the transformative college process. He subscribes to Ethan’s “ease, joy, and purpose” mission in all stages of the college process, but especially building college lists. Beyond the computer, New York, New Mexico, and Tennessee are Logan’s favorite states. Only North Dakota & Alaska to go.