This lesson covers...

Your student aid report and what it means for your financial aid outcomes

Time

8 minutes… tops

By the end you should...

Know whether you’ll be receiving a Pell Grant, and for how much

Know the difference between subsidized and unsubsidized loans

Know your EFC, what it means, and how it will be used

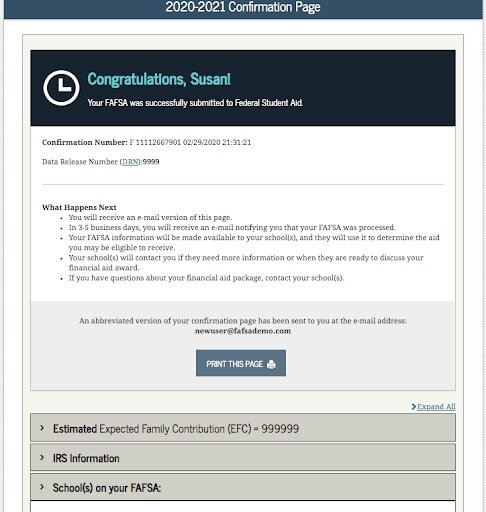

So you’ve just finished the FAFSA (congratulations again), and this is the screen you see.

Awesome. Now look down where it says, “Estimated Expected Family Contribution (EFC).”

Susan’s (the totally fake example above) says 999999.

Your EFC is also six digits. But it’s likely a much, much lower number. It may even be “000000” which is awesome. (Seriously, zero EFCs rock.)

Before we dive into what your EFC means, let’s see what you’ve won!

Click on that EFC tab.

The first thing I want you to look for are the words “Pell Grant.”

Do you see them? Awesome!

This is free money from the federal government that you can automatically take to any of the colleges you listed on your FAFSA form! The max for the 2021-2022 is almost $6,500, and it tends to go up $50-$100 every year. It may pop up to $9,000+ starting in 2022—depending on the government.

If you don’t see a Pell Grant listed, don’t fret. You still could get some free money; we’ll talk about that in a second.

The next thing to look for is “Direct Loan Estimate.”

You’ll definitely see this one. I even know what it says.

If you’re a dependent student (meaning you used parent tax info), it says $5,500.

It may split it up into $3,500 and $2,000, or some other split of $5,500, which is a good thing!

If you’re an independent student (meaning you didn’t use parent info), it says $9,500.

The “subsidized” one is zero interest—provided you stay in school full-time—until 6 months after you graduate, which is a really good deal on a loan! Definitely take this out if you need any loans to help you pay for college as this is the best loan offer you’ll get, hands-down.

“Unsubsidized” loans are regular loans in that they accrue interest from the time you take them out until you pay them off. These usually have a pretty good interest rate, but you may want to check with your folks before taking these out to see if they can get a better interest rate through their bank or through a state program (like these ones for North Carolina). Keep in mind that federal loans can offer repayment options that private loans may lack.

You don’t have to make payments on either of these loans until after you’ve been out of college six months. So don’t skip a semester or you might have to figure some things out!

Loans are the participation trophies of the FAFSA: everybody gets one for playing.

Just because you’re offered a loan doesn’t mean you have to take out any of it. It also doesn’t mean you’re all done applying for the loan. While it is guaranteed that you’ll get it, you’ll have to sign some paperwork online saying you definitely want to take it out and that you agree to pay it back.

So aside from the federal aid, what was the purpose of me filling out the FAFSA?

Four words: State and institutional aid. Regardless of whether you got free money from the federal government, you could still get grants from your state or colleges.

Let’s circle back to that EFC to talk about how this works.

Your EFC is telling the colleges you listed just how much your family can reasonably afford (be expected) to pay for your freshman year of college.

So, in our fake example above, Susan (and likely her imaginary parents) can afford about $1 million for her first year of college. Go them.

Take a moment to consider what your EFC translates to. For example, 008192 would mean the colleges will think you can come up with $8,192 for your freshman year of college.

For many families, the EFC is higher than they might expect or like, but there’s not much you can do about that unless the taxes reported on the FAFSA are way different than your family’s income now. (Remember, FAFSA uses “prior-prior year” taxes: take your high school graduation year and subtract two and that’s your freshman year FAFSA tax information.)

If your family’s income has drastically changed in the last year (and not for the better), there are two paths you can take: If one or more of your colleges asks for the CSS Profile, don’t worry, because for these colleges you’ll have the chance to show and explain your circumstances on the CSS Profile form. If one or more of your colleges doesn’t ask for the CSS Profile, then, once you’ve been accepted to the college, you can reach out to the financial aid office to let them know there’s been a drastic change between the FAFSA year and your current situation. They may help you out. They may not.

How do I know if my college needs the CSS Profile? You can check here, or just hold that thought for a couple minutes until we circle back to it at the end of this section.

How do colleges use my EFC?

Let’s say the cost of attendance (COA) at Evergreen Forest College is $50,000 per year.

Let’s also say that Johnny—who has been accepted at Evergreen Forest—has an EFC of 005000, which the college interprets to mean that his family can reasonably afford $5,000 for his first year of college.

Now let’s apply the core financial aid formula that all colleges use:

COA - EFC = Need

$50,000 - $5,000 = $45,000 of need for Johnny’s freshman year

This means Johnny could receive up to $45,000 in free grant money.

Now, will Johnny definitely get $45,000 in free money? Usually no, but it depends. Do the colleges he applied to promise to meet full need with no loans for all students, or some students, or no one? There are relatively few colleges that do meet full need for every student, and most of them are pretty tough to get into and require a CSS Profile so they can dig deeper than the FAFSA does into Johnny’s financial situation. (Again, hold on to that CSS Profile thought.)

But is Johnny likely to get some or most of his need met? Absolutely! It all depends on how badly the college wants him, how much money it has to give, and whether it focuses on merit aid or need-based aid or both.

In short, the higher your need (meaning the lower your EFC), the more need-based money you are eligible to receive. And as long as your EFC is lower than the cost of one year at one of your colleges, you could receive some aid.

Take a moment to consider the costs of your colleges compared to your EFC.

Do you think you may qualify for lots and lots of grant aid? Awesome. You might want to check on those colleges’ policies at some point to see if they favor merit-based aid or need-based aid.

Do you think you’re unlikely to qualify for anything beyond the loans? Don’t sweat it. That’s what merit scholarships are for!

Does your EFC have an asterisk (one of these things→ * ) next to it? If so, you’ve definitely been selected for FAFSA Verification. If not, you may still be selected for verification, so it’s really, really important for you to keep an eye on whichever email account you used for the FAFSA for any email with “FAFSA Verification” in the subject line. You should be notified if you’ve been selected by March at the absolute latest. To find out more about these super important steps, click here.

One bit of advice before you sign yourself up for student debt: You may want to check out the 5 Mistakes to Avoid When Taking Out Student Loans; make sure you understand the terms and that you’re comfortable taking on the loans.

And be sure to check out a loan repayment calculator like this one, so you know what kind of debt and timeline you’re getting into.

So now that you’ve conquered a rite of passage for college-going seniors, what are you going to do next?

You’ve got some awesome options.

Awesome Option #1

Dive right into the boss-level challenge that is the CSS Profile so you can get aid from the colleges you are applying to that require this form. You’re already in the zone and have most of the paperwork handy, so why not? Just make sure you’ve got snacks and are sitting comfortably.

Not sure if you need to do this form or not? There’s a super easy way to check at the beginning of the section.

Awesome Option #2

If you haven’t already, check out how affordable each of your colleges is likely to be by using a school’s Net Price Calculator (NPC—the tools on college websites that calculate how much you’re likely to get/pay). You can search for different schools’ NPCs from this link. Many NPCs have a spot for EFC that lets you skip a bunch of financial questions to get to their answer much quicker.

Awesome Option #3

It’s never too late to start applying for scholarships! Deadlines pass every day, so there’s no time like the present! Especially if you’ve got a higher EFC you know isn't going to help you very much in the need-based aid department.

Awesome Option #4

If it’s late in your senior year, and you know which college you’re going to and know that you definitely want the loans you’ve been offered in your financial aid package, you can start working on the loan entrance counseling here. You’ve already got your FSA ID handy to log in.

Or … take a break! You’ve earned it. Sure, there’s a lot to do, and you shouldn’t put it off too long. But you’ve earned a celebratory smoothie, coffee, [insert tasty treat of choice here].

The website will still be here when you get back. Just leave the tab open so you’ll be able to pick up where you left off when you’re ready.